We are a highly networked, multi-cultural and multi-lingual partnership with proven investment judgement

As an owner-managed firm, we are entrepreneurs at heart, and we are passionate about European businesses. When it comes to successful private equity deals, it’s the people who make the difference, and at Keyhaven our Partners manage each investment that we make. We are a diverse group of individuals who have worked across different countries and industries, and we have a long track record of more than 25 years each in private equity, and over 10 years together.

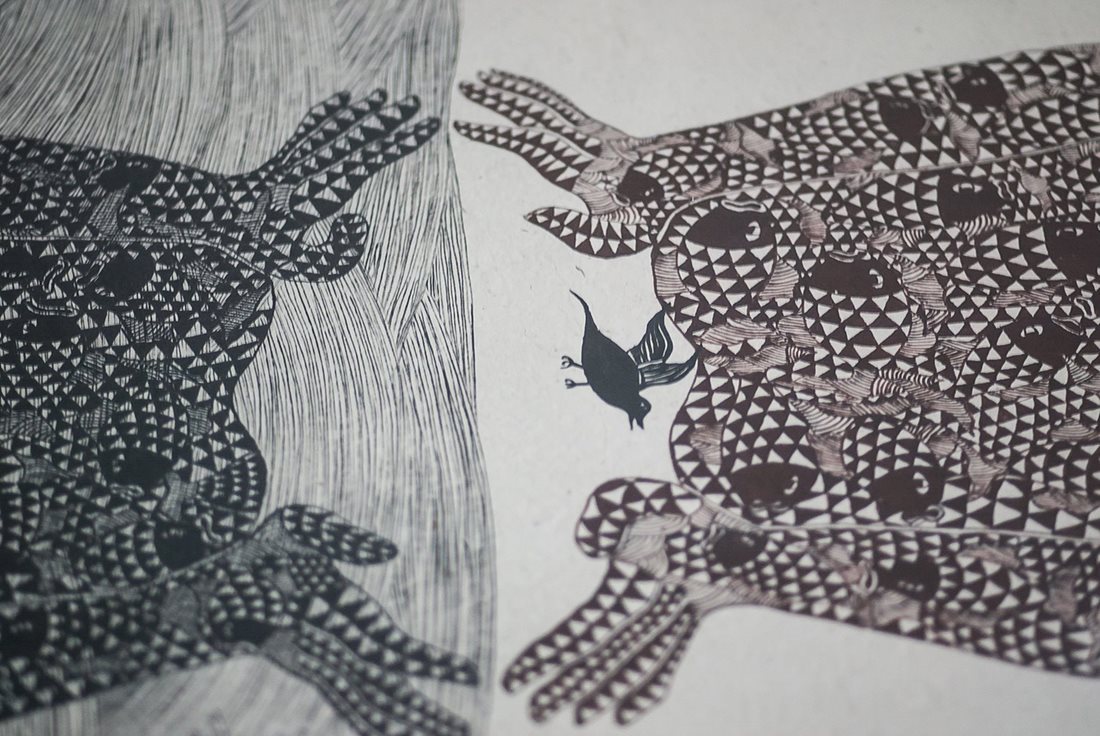

The broader Keyhaven team is comprised of individuals with diverse professional backgrounds, nationalities and language capabilities: we hail from 16 countries and we speak 20 languages. This rich heritage serves as the central building block of our firm, and informs our culture, strategy, and execution capabilities. We are a complementary mix of people who share a sense of ambition, a questioning nature and an open-minded, creative and friendly approach. The Keyhaven team's broad cultural awareness, strong language capabilities, and deep industrial experience positions us exceptionally well for European lower mid-market investing, where local networks and knowledge are vital to forming good judgement, which in turn is key to creating long-term high quality performance.

In addition, we work closely with a group of Senior Advisers, who are individuals with a broad range of operational and investment experience from different industries and geographies. They provide us with active support and insights in the sourcing and evaluation of investment opportunities, and also assist the Keyhaven team in monitoring and performing regular reviews of our portfolio companies.

Samuel Adeyiga

Analyst

Samuel focuses on database maintenance, general market research and assisting in the sourcing, analysis, monitoring and exiting of investments. In addition, he works in the Firm’s investor relations and marketing team. Before joining Keyhaven, Samuel completed several internships, most recently at Pension Insurance Corporation within their Debt Origination Team.

Samuel has a BEng in Chemical Engineering from the University of Bath.

Salina Allie

Partner & COO

Salina has over 30 years of investing and operational experience across the UK, Europe and the Caribbean. She is a member of Keyhaven’s Investment Committee and manages firm-wide operations. Before joining the firm, Salina was employed with London Fund Managers, and her previous experience also includes roles at AXA Investment Managers, Morgan Cole Solicitors and The Communications Innovation Group. Earlier in her career Salina worked at the Demerara Distilleries in Georgetown, Guyana.

Salina spearheads Keyhaven’s engagement with two key organisations, Black Women in Asset Management (BWAM) and 10,000 Black Interns. Beyond her role at Keyhaven, she is a mentor for Action for Race Equality, a national UK charity, delivering programmes to raise the aspirations of young black, Asian and minority groups between the age of 11-24 years to succeed in education and employment.

Salina holds a BSc in Business Administration with honours from Cardiff University and an MSc in Management Studies from Brunel University.

Sarah Baha

Chief Compliance Officer

Sarah has 10 years of compliance and other relevant experience. At Keyhaven, she leads the firm’s compliance function, and serves as a member of the Firm’s Investment Committee. Sarah is responsible for developing and executing Keyhaven’s compliance programme, as well as ensuring that the company operates in a legal and ethical manner while meeting its business goals. Before joining Keyhaven, Sarah was Junior Compliance Officer at Union Bancaire Privée in Geneva. Prior to this, she worked at Credit Suisse as a Pre-Compliance Team Assistant in Geneva.

Sarah has a BA in Law from Geneva University, a Bilingual Masters in Civil and Criminal Law from Geneva University and Basel University and a Certificate of Advanced Studies in Legal Professions from Geneva University. She is fluent in English, French, German and Spanish.

Petra Balaziova

Senior Fund Accountant

Petra has 16 years of experience in finance and back office operations. She assists in the management of the day to day back office and the fund administration for the Keyhaven funds. Before joining Keyhaven, Petra was a Fund Accountant for Montagu Private Equity and Mainspring Fund Services Limited. Prior to this, she worked as a Project Accountant at IQEQ (Global) UK Limited and an Assistant Accountant at Tish Leibovitch Accountants.

Keith Bratton

Head of Fund Accounting

Keith has 19 years of experience in finance and back office operations. He is responsible at Keyhaven for the fund administration. Before joining Keyhaven, Keith was a Senior Fund Controller at Park Square Capital. Prior to this, he was a Client Services Accountant at Augentius and a Trainee Accountant at TK Magee & Co. Keith began his career at PricewaterhouseCoopers.

Keith has a MSc in Professional Accountancy from the University of London and is ACCA qualified.

Sarah Brereton

Partner & Co-Head of Investment

Sarah has 13 years of experience in private equity and finance. She is a member of the Investment Committee, and co-manages Keyhaven’s Investment Team, with particular responsibility for the firm’s activities in the UK & Ireland, and the Nordic and Benelux regions. Sarah is responsible for leading the investment process including due diligence, negotiating transactions and managing relationships with advisors, sponsors and management. She also plays a key role on investor relations activities.

Her current and past observer and board positions include elseco, Phrasee, and Steer Automotive Group. In addition, she holds LPAC positions on Keyhaven’s investments into SSI Diagnostica and Capital D.

Before joining Keyhaven, Sarah served as a Corporate Finance Executive for Gaelectric Holdings. Previous to this, she was a Senior Associate in the audit division of KPMG in Ireland. Sarah has a BA in Business and Law with honours from University College Dublin and is ACA qualified.

Matthew Cloke

Senior Analyst

Matthew has six years of relevant experience. He focuses on database maintenance, general market research and assisting in the sourcing, analysis, monitoring and exiting of investments. In addition, Matthew works in the Firm’s investor relations and marketing team. He currently serves as an observer to the board of PCML Group. Before joining Keyhaven, Matthew was an Assistant Manager in Private Capital Audit at Deloitte.

Matthew has a BSc in Economics with Industrial Experience from the University of Exeter and is ACA qualified. He is fluent in English and conversational in French.

Marta Miró Federico

Investor Relations Analyst

Marta Miró has five years of experience working in private equity and finance. Her responsibilities include supporting all aspects of investor relations and fundraising activities. Marta Miró was previously an Investor Relations Associate at VenCap. Prior to this, she was an Investment Banking Analyst at Houlihan Lokey covering Financial Sponsors and she started her career in Leveraged Finance at UniCredit.

Marta Miró holds a BSc in Economics and Management from King’s College London and an MSc in Global Management from The London School of Economics and Political Sciences. She is fluent in English, Italian and Spanish.

Michael Haddad

Head of Investor Relations

Michael has eight years of experience in private equity and finance. He is responsible for managing all aspects of investor relations, fundraising, and the firm’s media and PR strategy.

Before joining Keyhaven, he worked at Nomura International’s sales and trading division, and AXA Investment Managers in London.

Michael has a BSc in Economics from Brunel University and an MSc in Corporate Finance from Bayes Business School. He is fluent in English and Arabic.

Natasha Hill

Finance Administrator

Natasha has 16 years of experience in finance and back office operations. She assists in the management of the day to day back office and the administration for the Keyhaven funds. Before joining Keyhaven, she gained experience at Grant Thornton, Love Success, and BritBound Limited in the UK, and Bendigo Bank and ANZ Bank in Australia.

Hanna Hognestad

Analyst

Hanna focuses on database maintenance, general market research and assisting in the sourcing, analysis, monitoring and exiting of investments. In addition, she works in the Firm’s investor relations and marketing team. Before joining Keyhaven, Hanna was an Associate in the Audit division of KPMG in Oslo. Prior to this, she was an M&A Analyst at First Mover Group.

Hanna has an MA in Business and Finance and an MSc in Finance and Management from Heriot-Watt University, Edinburgh. She is fluent in English, Norwegian, Swedish and Danish.

Oliver Jordan

Fund Accountant

Oliver has 5 years of experience in finance and back office operations. He assists in the management of the day to day back office and the fund administration for the Keyhaven funds. Before joining Keyhaven, he was a Fund Accountant at Langham Hall where he began his career as a Trainee Accountant on their graduate scheme.

Oliver has a BA in Accounting and Finance from Bournemouth University and is ACCA qualified.

Vignesh Kumaravel

Investment Director

Vignesh has 12 years of experience in private equity and finance. He is responsible for managing the investment process, including the sourcing, analysis, monitoring and exiting of investments. His current and past observer and board positions include Real Good Dental, DARAG Group, elseco and Steer Automotive Group.

Before joining Keyhaven, Vignesh was an Investment Associate at Kester Capital. Prior to this, he spent seven years at PricewaterhouseCoopers, most recently as a Manager in the transaction services division in London.

Vignesh has a BSc (Hons) in Economics from Warwick University and is ACA qualified. In addition, he is a CFA Charterholder. Vignesh is fluent in English and Tamil and speaks conversational Spanish.

Diana Marr

Investment Director

Diana has 22 years of experience in private equity and corporate finance. She is responsible for managing the investment process, including the sourcing, analysis, monitoring and exiting of investments. Diana currently serves as member or observer on the boards/LPAC of Amethyst Radiotherapy, Optimapharm and MyFamily.

Before joining Keyhaven, Diana was a Managing Director in the M&A team at BDO Corporate Finance leading M&A transactions in technology and media, business services and consumer sectors. Prior to this, she was a Senior Corporate Finance Advisor at Clarges Capital Limited and Bridge Europe Consulting in London and a Senior Investment Manager at Gemisa Investments in the CEE. Diana started her career at AIG - New Europe Fund, American International Group Capital Management’s private equity fund based in the CEE.

Diana has BA degrees in Business Administration and Political Science/International Relations from the American University in Bulgaria and an MSc in Finance from Bayes Business School in London. She is fluent in English, Romanian, French and she also speaks conversational Italian.

Teddy Mouawad

Partner & Co-Head of Investment

Teddy has 15 years of experience in private equity and finance. He is a member of the firm’s Investment Committee and co-manages Keyhaven’s Investment Team, with particular responsibility for the firm’s activities across France and Southern Europe. He is responsible for leading the investment process including due diligence, negotiating transactions and managing relationships with advisors, sponsors and management. He also plays a key role on investor relations activities.

Teddy currently serves as member or observer on the boards/LPAC of Proclinic, Surexport, Novation Tech and Buffet Crampon. He previously represented Keyhaven on the boards of Pet Network International and Mazarine.

Prior to joining Keyhaven, Teddy worked across several finance functions within British American Tobacco’s headquarters in London. He holds a degree in Business Administration from the American University of Beirut, an MSc in Finance from Bayes Business School, and is ACMA qualified. Teddy is fluent in English, French and Arabic.

Grace Ridge

Analyst

Grace has five years of relevant experience. She focuses on database maintenance, general market research and assisting in the sourcing, analysis, monitoring and exiting of investments. Before joining Keyhaven, Grace was an Assistant Manager in the M&A team at Forvis Mazars (formally Mazars). Prior to this, she was an Accounts Assistant at Blackdown Hills Accounting Limited.

Grace has a BSc in Accounting and Finance from Cardiff University and is ACA qualified.

Mehreen Saleem

Senior Fund Accountant

Mehreen has 10 years of experience in finance and back office operations. She assists in the management of the day to day back office and the fund administration for the Keyhaven funds. Before joining Keyhaven, she worked as an Associate for OakNorth Bank Limited. Prior to this, she was a Financial Assistant at Copal Partners (UK) Limited.

Mehreen has a BSc in Finance and Accounting with honours from Brunel University. She is fluent in English, Urdu, Hindi and Punjabi.

Ben Sartori

Fund Accountant

Ben has 5 years of experience in finance and back office operations. He assists in the management of the day to day back office and the fund administration for the Keyhaven funds. Before joining Keyhaven, he was a Senior Associate Fund Accountant at Standish Management. Prior to this, he began his career as an Analyst at AlphaSkill Limited.

Ben has a BSc in Accounting and Finance from the University of Bristol and is ACCA qualified.

Olga Sasaki

Head of Finance Operations

Olga has 16 years of experience in finance and back office operations. She is responsible for managing corporate accounts and providing operational support to achieve the company’s goals. Before joining Keyhaven, Olga was a Senior Manager at Langham Hall for two years. She previously worked at Keyhaven as a Fund Accountant for over five years. Olga began her career in Fund Accounting at Langham Hall, prior to this she worked at WHEB, and held the position of Financial Management Accountant.

Olga has a BSc in Finance and Banking with honours from East London University, an MSc in Professional Accountancy from London University, and is FCCA qualified. She is fluent in English, Russian and Lithuanian.

Birgitt Schmidhofer

Marketing Lead

Birgitt has four years of marketing and media experience. She assists in the development of the Firm’s social media and marketing strategy across all platforms. In addition, she works closely with the Investor Relations team, focusing on our online content, PR and branding to better engage with our key audiences. Before joining Keyhaven, Birgitt was a Digital Marketing Coordinator at Encore, a global event production company.

Birgitt holds a BSc in Marketing and Management from Queen Mary University of London and is fluent in English and German.

Claus Stenbaek

Managing Partner

Claus has over 40 years of direct private equity as well as quoted securities experience. In addition to managing Keyhaven Capital Partners, he is a member of the Investment Committee and is also responsible for overseeing the investment process. Claus is the Chairman of Novation Tech S.p.A. He was previously Chairman of TCX S.p.A., LRI Invest and Darag Group. From 2012 to 2018, Claus was a member of the Invest Europe Limited Partner Platform Council, and he was also appointed to the Invest Europe Audit and Financial Committee.

Before founding Keyhaven, Claus was Executive Director of Danske Private Equity. His earlier positions include Founding Managing Director of Richmond Capital Limited, a niche investment bank, and managing a European family office. Claus has also served as CFO of engineering company F.L.Smidth & Cia Espanola, and as a Senior Consultant with Andersen Consulting (now Accenture). He has served as Chairman and/or Board Member of more than 30 private and public companies in Europe and the United States over the course of his career.

Claus has a BSc in Finance and Accounting from Copenhagen Business School and earned an Executive MBA cum laude from Instituto de Impresa, Madrid. He is fluent in English, Danish, Norwegian and Swedish, and also speaks Italian, Spanish, French and German.

Sasha van den Blink

Founding Partner & Chairman

Sasha has over 30 years of experience in European private equity. At Keyhaven, she focuses on strategic matters, overseeing the business and ensuring adherence to the highest governance standards. In addition, she serves as Chairman of the Investment Committee. Sasha currently sits on the Board of Novation Tech S.p.A. Her past board and observer seats include TCX S.p.A., Barbara Sturm Molecular Cosmetics GmbH and Optimapharm. Sasha is a co-Founder of Level 20, a not-for-profit organisation founded to inspire women to join and succeed in the European private equity industry. She also serves as a Trustee of LIFE Generation UK, a charity formed to support higher education and the youth employment in Lebanon.

Before founding Keyhaven, Sasha was Managing Director at AXA Investment Managers where she was responsible for setting up and developing its European private equity fund of funds programme. Prior to joining AXA Investment Managers, she was employed by an affiliate of BT Alex. Brown (now Deutsche Bank). Sasha previously worked as a consultant for Cambridge Associates, an investment advisory firm, in both their London and Boston offices.

Sasha has a BA cum laude degree from Wellesley College. She is fluent in Dutch and English, and speaks conversational Italian, Spanish and Arabic.

Andrew Ware

Partner & CFO

Andrew has over 40 years of experience in private equity and M&A. He is a member of the Investment Committee and is responsible for the oversight and management of the finance function, as well as supporting the firm’s deal execution and monitoring capabilities. Andrew currently serves as an observer to the boards of OUTCO and PCML Group, and previously Steer Automotive Group.

Before joining Keyhaven, Andrew served as the CFO/COO of Karen Millen Group, a London based international fashion retailer operating in over 65 countries. Previous to this, he spent 14 years as a Partner at BDO in a variety of leadership position within the Corporate Finance division, including founding the Private Equity advisory group, leading the London advisory business and Corporate Finance team, and heading National Corporate Finance. In addition, he was a member of the International M&A team and provided strategic support to the BDO management board. He began his career with Deloitte Haskins and Sells, where he qualified as a Chartered Accountant.

Andrew earned a BSc in Economics with honours from Swansea University and has undertaken various executive education courses at Harvard Business School.

Nicola Williamson

Office Manager

Nicola has 16 years of relevant experience. In addition to managing all aspects of the office she provides administrative support to Keyhaven’s Partners. Nicola has gained experience in the course of her career, through her work with companies which include Solium Capital UK, The BB Group, Downham Health & Leisure Centre and Cadrex Overseas Limited based in Cyprus.